Note: Social Securities and the NHS contributions are subject to change every year by a small %; consequently the below % may not be accurate at the tome of your enquiry.

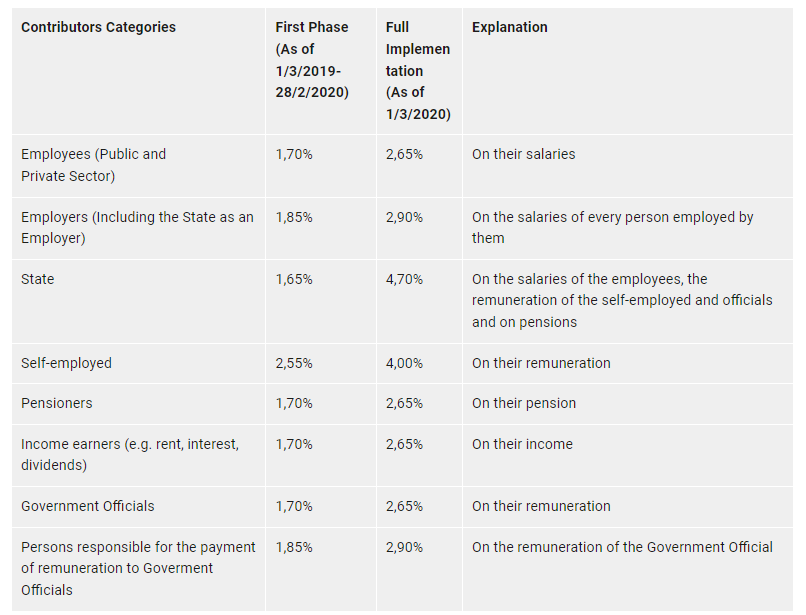

National Healthcare System (GESY / NHS) & Social Insurance cost

Whether a self-employed person or an employer, you must immediately inform the Social Insurance as soon as you hire a new employee. Together with the social insurance contributions the NHs / GESY contributions should also be deducted, each month or depending on physical persons income streams.

At present, Social insurance cost for the company is 14,9% of the gross salary of the employee, while the cost for the employee rises to 8,3% and any tax that needs to be paid in case of taxable income over 19.500 euro which is the tax-free amount. The employer pays the 14,9% (8.3% plus other contributions 3,7% and NHS 2,9%) on the employee’s salary to the authorities and deducts the 8,3% from the employee’s salary.

National Health System Cyprus (NHS)

Salaries Deductions:

Salaries will be paid net of the NHS / GESY contributions similarly to the social insurance contributions are deducted. The Social Insurance office has amended its forms and online portal for the GESY contributions so that both contributions are collected by the Social Insurance Office every month.

The Maximum obligatory amount for the Social Insurance Contributions is Euro 54,648 and it is different from the Maximum obligatory GESY contributions of Euro 180,000.

Recruitment of Staff

In Cyprus, each salaried person or self-employed person must have a Personal Tax Identification Code (T.I.C) and a Personal Social Insurance Number (S.I.C). Consequently, the registration of personnel is made through the Social Insurance Office and the Income Tax Office, unfortunately, on a paper application.

The procedure is not complicated and it usually takes 10 working days for an employee to be registered with the Social Insurance Office and the Income Tax Office. In the event that the Company / Sole Trader is not registered as an employer, it should also register as an employer first and then register the employees under his/her name.

Minimum wage

As per the Social Insurance guidelines, for full-time office staff the Minimum Monthly Wage upon recruitment is €870, while the minimum monthly wage for employees, who have completed a six-month period of employment at the same employer, is €924 (other rates apply for other professions). Normal working hours are usually 38 to 40 hours based on normal practice and agreement with each employer.

It is important to note that the minimum wage for salaried and self-employed persons varies depending on the profession and it is predetermined by the Social Insurance Office, where it can be obtained upon request.

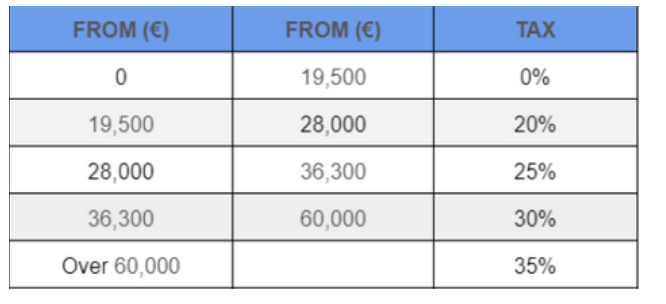

Pay as you earn (PAYE) income tax

In the cases where the employee’s taxable income (i.e. Gross salary less Social insurance paid) is over the threshold of EURO 19.500, then tax for the employee arises as per the below table.

PAYE Brackets are as follows:

The employer is informed by its staff of all taxable income and personal circumstances which could lead to a different tax treatment by completing the form IR.59 at the beginning of each year. The employer collects these forms and calculates the appropriate PAYE deductions based on the information provided on these forms.

Contracts of Employment & Termination of Employment

The amount of PAYE tax is calculated on the estimated income of the employee for the year at the begging of each year and is divided by 12 months. Bonuses and benefits in kind are also included as salaried income and taxed accordingly.

Note: Benefits in Kind and Bonuses are normally subject to Social Insurance Contributions, NHS and P.A.Y.E

The Year-End final payroll taxes (PAYE, NHS, SIC), should agree to the IR.63 and must be matched by the monthly deductions and contributions of these taxes. Any taxes due should be calculated at the year-end and be settled via a year-end payment/settlement/employee deduction.

Reconciliation Exercise

By adding the total taxable income including the bonus and benefits in kind for the entire year and proceeding with the PAYE, SIC, and NHS calculations you must agree to the monthly tax deductions for the year (including the Bonus and Benefit in Kind paid in December).

Contracts of Employment & Termination of Employment

For all the employees, long-term or short-term contracts need to be signed and all the terms and conditions to be agreed upon between the employer and the employee. The contracts must include, among others, the position, salary, days of holiday and sick leave, and termination conditions.

Employee Terminates Employment:

- Length of employment Minimum term of notice

- From 26 up to 51 weeks (6 months – 1 year) --> 1 week

- From 52 up to 259 weeks (1 year– 5 years) --> 2 weeks

- From 260 weeks and over (5 years +) --> 3 weeks

Employer Terminates Employment:

- Length of employment Minimum term of notice

- Up to 26 weeks (6 months) No notice required

- From 26 up to 51 weeks (6 months – 1 year) --> 1 week

- From 52 up to 103 weeks (1 year – 2 years) --> 2 weeks

- From 104 up to 155 weeks (2 years – 3 years) --> 4 weeks

- From 156 up to 207 weeks (3 years – 4 years) --> 5 weeks

- From 208 up to 259 weeks (4 years – 5 years) --> 6 weeks

- From 260 up to 311 weeks (5 years – 6 years) --> 7 weeks

- From 312 weeks and over (6 years +) --> 8 weeks

Other Obligations

All employers must provide their employees with their monthly payslip which indicates the monthly gross salary and corresponding deductions and contributions of the employee's net salary. In addition, they must prepare and submit the Employer’s Tax Return (IR.7) to the tax authorities by the 31 of July of the following year. For instance, for 2021 the IR.7 has to be submitted by 31.07.2022.

At the end of each year, all employers must prepare and provide to their staff an official form (IR.63) stating the annual gross salary with all deductions and contributions for the year. This form will be thereon used by the employees to prepare their tax returns.

Usually, this form is provided to the employees from March to April of the next year.

All forms, Payslips, IR.7 & IR.63 are completed by the accountant of the Company / Employer.

Other Employee’s Obligations

All the employees registered with the tax authorities need to complete and submit their tax return (IR.1) stating their income from employment and any other income.

The tax return shall be submitted electronically by the 31 of July the following year

i.e. for 2021, it will be 31.07.2022.

In this form, a calculation of their tax is also included and any differences between the PAYE already paid and the actual tax need to be settled by 30 of June the following year i.e. for 2021 it will be the 30.06.2022.

In the event tax paid is higher than the actual tax due then the excess amount will be refunded by the authorities once the tax return is examined.